A cryptocurrency investment can be just as thrilling as it is fearful. This is because of the volatility character associated with the cryptocurrency market. Most of the time, the traders find themselves asking if they are at the right time to either buy and sell cryptocurrencies

This book will allow you to acquire the information and materials that are necessary for making informed decisions when you are trading. You can enhance your profit-making in trading by understanding what is happening in the market and using strategies that are proven to work.

Understanding the Trends of the Market

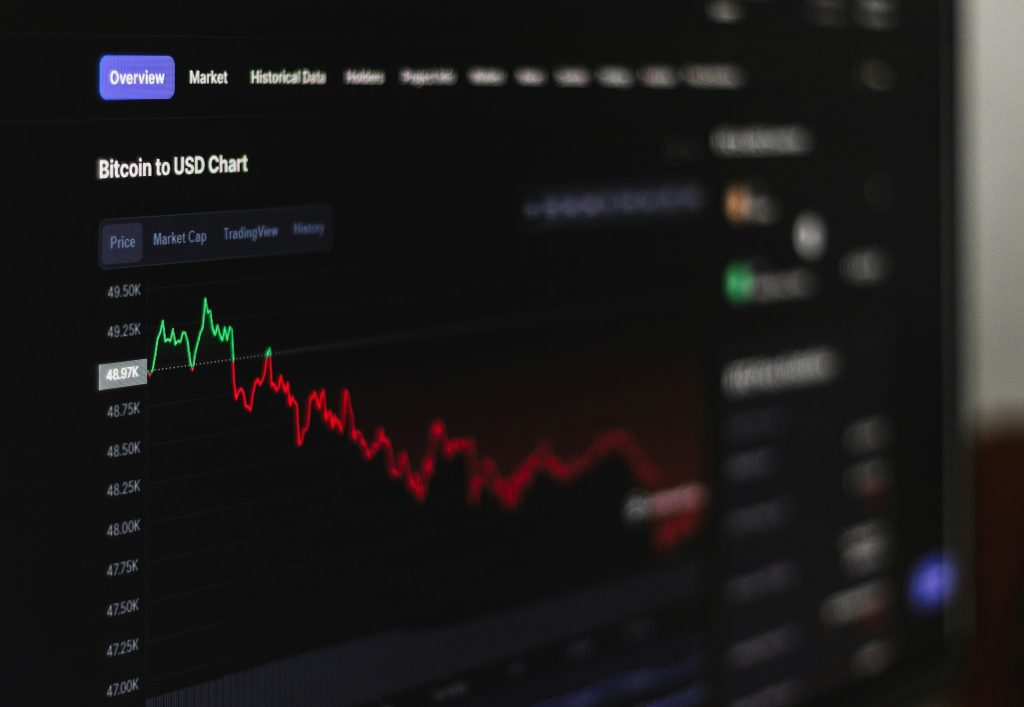

Although that is the case, it is essential to know the nature of the market before getting deep into the crypto buying and selling strategies. There are a lot of factors upon which the cryptocurrency market changes. Examples include market sentiment, technological breakthroughs, regulatory news, and macroeconomic situations. To be able to buy and sell cryptocurrencies at the right moment, it is essential to be cognizant of whether the market is bullish or bearish.

Bullish Market: It is only considered to be bullish when prices are rising and confidence among investors is strong. The thought that the prices will somehow keep rising presents a force that pushes the traders out to find opportunities for buying at this point in time.

Bearish Market: It is characterized by falling prices and low investor confidence. Such markets are characterized by both these factors. The trader can either sell assets to curb the loss or wait for the turn-around in the market to make purchases. Both of these options are practically possible in this case.

Best Time to Buy and Sell Cryptocurrencies

Cryptocurrency buyers who want to know when the best times are to buy and sell must use technical analysis. Traders can find trends and guess how prices will move in the future by looking at price charts and using different indicators.

Technical Analysis:

Here are some important technical signs that can help you figure out how the market is doing:

Moving Averages: To find trends over time, moving averages smooth out price data. The simple moving average (SMA) and the exponential moving average (EMA) are the moving averages that are used the most.

The Relative Strength Index (RSI): The RSI looks at how fast and how the prices are changing to show when they are high or oversold. An RSI above 70 means that the price has been bought too much, while an RSI below 30 means that the price has been sold too little.

Moving Average Convergence Divergence (MACD): It is an indicator that helps traders find possible buy and sell signs by showing how two moving averages are related to each other.

Best Time to Buy Cryptocurrency

Ideally, you would always purchase cryptocurrency when prices have declined significantly or just stabilized after declining. One good way you know this happens when you check the RSI: below 30 means that asset could be in an oversold condition and thus could bounce back. Another best time to buy cryptocurrency is during market pullbacks once the trends are seen reversing. Also you can find good entries based on shifting moving averages.

Best Time to Sell

Normally, the sweetest time to sell cryptocurrencies is when their prices are high or reflect that the asset might be overbought. When an RSI is above 70, it can be a sign that an asset has already reached its peak value. If you view a downtrend of moving averages or bearish signals from the MACD, you want to sell. Selling at the top of the market allows you to capture gain before losing it in a possible decline.

Implementing a Trading Strategy

Having a well-defined trading strategy can significantly enhance your decision-making process to buy and sell cryptocurrencies. Here are some strategies to consider:

1. Buy Low, Sell High

The age-old principle of buying low and selling high is fundamental in trading. Monitor the price movements of cryptocurrencies and look for dips to buy in. Conversely, when prices rise significantly, consider selling to lock in profits.

2. Dollar Cost Averaging

In dollar-cost averaging, the asset price is irrelevant; what matters is that a constant amount of money is invested at regular intervals. The average cost per unit of cryptocurrency can be reduced over time and the impact of volatility can be mitigated with this technique.

3. Trend Following

Trend following is a strategy that involves buying when the market is trending upward and selling during downward trends. Utilize moving averages to confirm trends and time your entries and exits accordingly.

4. Using Stop-Loss Orders

Stop-loss orders can protect your investments by automatically selling your assets when they reach a predetermined price. This strategy helps minimize potential losses in a volatile market.

Monitoring the Trends of the Market

In most cases, market sentiment tends to significantly influence price movement in the case of buy and sell cryptocurrencies. One can make a wide range of educated guesses on what the people trading these currencies think about them by paying attention to all that’s happening on social media and inside news stories as well as reading through community debates.

Positive Sentiment: A surge in positive news or endorsements can lead to increased buying activity, driving prices up.

Negative Sentiment: Conversely, negative news can trigger panic selling, leading to price declines.

Using Trading Tools

Using various pieces of digital technology available, your trading career can be lifted high. One of the tools is TradingView. It is among the most common tools used in drawing conclusions about price charts and technical indicators. And it can help you make a better decision about when to buy and sell cryptocurrencies.

Setting up TradingView to Start Work

Now to utilize tradingview effectively, follow these processes:

- Visit tradingview.com and create an account.

- Please select the cryptocurrency you wish to be studied.

- Make sure your chart contains all the information of interest, such as the moving averages.

- Customize the settings for the indicator in order to suit your strategy.

Moving Averages Concept

Many of the trading strategies involve the moving averages as an integral part to decide the best time of day to trade crypto. The following are some likely buy and sell signals which could be determined by traders through the study of the interaction between some multiple moving averages.

Short-Term Moving Averages: These are well used for the day trades because they can help in the identification of short-term trends.

Long-Term Moving Averages: This gives a clearer view of market patterns and is therefore better suited for long-term investments.

Controlling the Risks

Risk management is important to become successful in trading. In an attempt to make it easier for you to control your risks to buy and sell cryptocurrencies, here are some tips:

Only Invest What You Can Afford to Lose: Because cryptocurrency markets are never predictable. In that case, you should ensure that what you are about to invest in comes within your financial limits.

Diversify your portfolio: Spread your investments across several different cryptos so that you may temper the impact of any bad performance by one asset.

Define Realistic Objectives: In order to make decisions that are not based on emotions, clear profit objectives along with an exit strategy must be defined.

Conclusion

A combination of market analysis, technical indications, and personal strategy is necessary in finding the appropriate times to buy and sell cryptocurrencies into investment. Using the resources and crypto buying and selling strategies offered in this article. Remember, after all, that the best part of trading is lifelong learning and the ability to adapt to changes in marketplace conditions.

Keep information on the market trends and make your trading techniques continually better as you start your journey into trading. The more patient you are and the more you practice, the better you will be at navigating this dynamic world of cryptocurrencies.

You May Like: Top 10 Cryptocurrency Business Ideas for 2024

You May Also Like: Everything You Need to Know About Starting a Crypto Business