Apple Pay is a mobile payment service that allows you to make payments by holding your phone near contactless readers.

You can use Apple Pay for in-store purchases, in apps, and on the web. Apple Pay can be used with any card from your supported credit or debit card issuer.

Apple Pay works with iPhone 6 and later models, Apple Watch, iPad Pro, iPad (5th generation), iPad Air 2, and iPad mini 3 and later models.

Read on to know more. Our main focus in this article is to guide you about “Does Apple Pay Have A Limit?”.

How much is Apple Pay sending limit

Apple Pay is a mobile payment service that lets you pay for purchases in stores and apps with your iPhone, Apple Watch, iPad or Mac.

The current limit is $2500 per transaction.

How much is Apple Pay weekly limit

Apple Pay allows users to pay for items in stores by tapping their phone on a point-of-sale system.

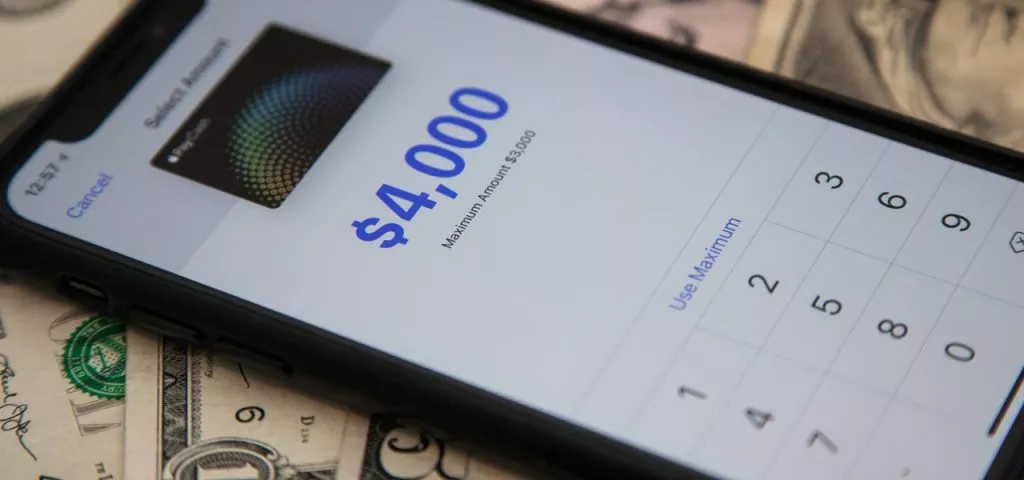

However, just like adding money, you are only permitted to send or receive up to $3,000 at a time or $10,000 over the course of 7 days.

How much is Apple Pay limit per day

Apple Pay is a mobile payment service that allows users to make purchases in physical stores with their smartphones. The limit of Apple Pay per day is $3000. Please contact your credit card company for more information on how to increase the Apple Pay limit and if it is possible in your case.

How to increase Apple pay limit

Apple Pay is a mobile payment system that allows you to use your iPhone, Apple Watch, or iPad to pay for goods and services. It’s a convenient way to make payments without having to carry your wallet around.

There are many ways in which one can increase the limit of their Apple Pay account. Some of them are as follows:

-Adding A Credit Card To Your Wallet: Adding a credit card to your wallet will allow you to spend more than your current limit.

-Setting Up Auto-Delivery: Setting up auto-delivery will allow you to purchase items from stores on a regular basis without having to worry about exceeding the spending limit.

-Contacting Apple Support: Contacting Apple Support will help you get an idea as to what might be causing the issue and how it can be resolved.

-Contacting The Store That Issued The Credit Card: Contacting the store that issued the credit card should help resolve any issues

How to increase Apple Card limit

Apple Card is a credit card from Apple, which is available for purchase in the United States. It is the first card to offer rewards and benefits in the form of an app.

There are two ways to increase your Apple Card limit:

– The first way is by using Apple Pay;

– The second way is by contacting customer service.

Apple Pay fees to cash out

Apple Pay is a payment service that allows users to make payments with their mobile devices. Apple Pay is an alternative to cash, credit cards, and other payment methods. Apple Pay offers two types of transactions:

In-person and online purchases

In-person transactions require the user to have their iPhone or Apple Watch nearby.

Online transactions require the user to have their iPhone or iPad nearby and use Safari on iOS or macOS.

Apple charges a fee for each transaction, but the fee varies depending on which type of transaction it is. The fee ranges from 1% – 3% for in-person purchases, while the fee ranges from 1% – 2% for online purchases.

What are the sending and receiving fees on Apple Cash?

Apple Cash is a new service by Apple that allows people to send and receive money from each other. It is a person-to-person payment service which means that it does not go through a bank or credit card company. This means that there are no fees for sending or receiving money, which is different than most of the other services out there.

The only fee associated with Apple Cash is the 3% fee if you buy something using Apple Cash on the iPhone, meaning you would have to spend more than $100 to get this fee back.

How do I avoid Apple Pay fees

To avoid Apple Pay fees, you need to make sure that you have a credit card that is compatible with Apple Pay. If your credit card is not compatible with Apple Pay, then you will be charged a fee for each transaction.

If your credit card is compatible with Apple Pay and you have an iPhone, then all you need to do is add your credit card to the Wallet app on your phone. You can add multiple cards and switch between them as needed.

What are the limits for adding to my Apple Cash balance?

Apple Cash is a new way to pay for things on the App Store and iTunes. You can use it to buy apps, games, music, movies, TV shows, and books. It’s also a great way to send money to friends and family.

You can add money to your Apple Cash balance by tapping “Add Funds” in the Wallet app on your iPhone or iPad. You’ll need an eligible debit card or credit card that supports contactless payments. If you don’t have one of these cards, you can set up Apple Pay Cash in Messages on your iPhone or iPad with an eligible debit card or credit card that supports contactless payments.

What are the limits for transferring money to my bank account on Apple Cash?

Apple Cash is a mobile payment service that lets you transfer money to your bank account. The limits for transferring money to your bank account on Apple Cash are:

A maximum of $3,000 can be transferred per day.

The minimum amount is $10 and the maximum amount is $3,000.

How much can I have in my Apple Cash balance at once?

After confirming your identity, you are permitted to have a maximum Apple Cash balance of $20,000. The most you can have in Apple Cash is $4,000 if you’re a member of the Apple Cash Family.

Final Verdict

Apple Cash allows you to send and receive money from friends and family, make purchases at participating stores, and withdraw money from any Apple Pay-supported ATM.

Apple Cash is designed to be a convenient way to spend money with the people you care about. You can use it to pay back the person who borrowed your car or foot the bill for your friend’s lunch. You can also use it as a gift card by sending cash directly to someone’s Apple Pay wallet.

You may like our other guides about:

Does Chick-Fill-A & In N Out take Apple Pay?