A company called Speedy Net Loan Reviews borrowers with lenders that are willing to provide them with short-term, low-interest payday loans. When you require a little additional cash to get you through to your next paycheck, this kind of service is perfect. Given that it can be quite pricey, it is not intended as a long-term financing option. With a nationwide database of over 100 lenders, Speedy Net Loan is a reputable, trusted, and secure business that approves requests from clients with less-than-perfect credit scores.

How do Speedy Net Loan Reviews Work?

This organization, Speedy Net Loan, connects you with a suitable lender rather than acting as a direct lender, as we already indicated in the opening of this article. You complete the application form, the business analyses your information, and then it identifies the best lender depending on your needs and financial capacity, as well as your location and other considerations. As a result, the business acts as a middleman between the clients and the direct lenders in their network.

Over 100 lenders make up Speedy Net Loan’s nationwide network, all of which are reputable and trustworthy as well as duly licensed in their respective jurisdictions. Since the lender determines how much money you can borrow, Speedy Net Loan has no influence whatsoever on the specific terms and circumstances of your loan. Nevertheless, Speedy Net Loan offers to assist you in obtaining lending between $100 and $1,000, which is essentially common in the payday loan industry.

You will have a set period to repay your loan after the lender has matched and authorized you, with the due date frequently falling on or near your next payday. For individuals who receive their payment twice a month, it is typically either a 14, 15, or 16-day period, or 30 days for those who receive their paycheck once a month.

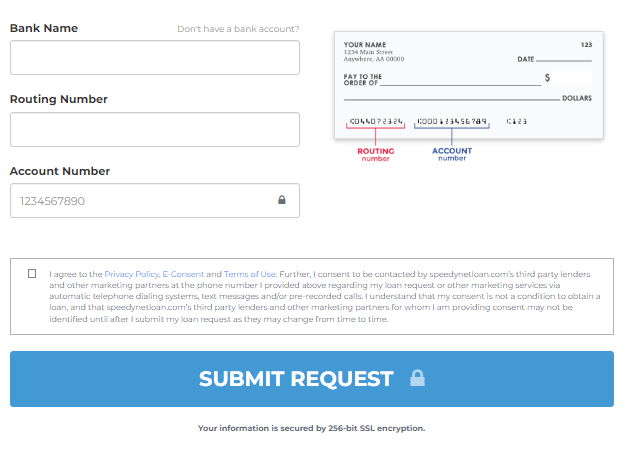

In addition, speedy loan reviews guarantee that they will assist any client in need of a payday loan, regardless of credit standing. If you are employed and have a current bank account, many lenders don’t even care about your credit score. This is crucial because, when your loan request has been granted, the money will often be sent to you or deposited electronically within 24 hours. Most of the time, the repayment will also be carried out automatically. Speedy Net Loan does not charge you anything to use its services or to complete and submit your application to lenders.

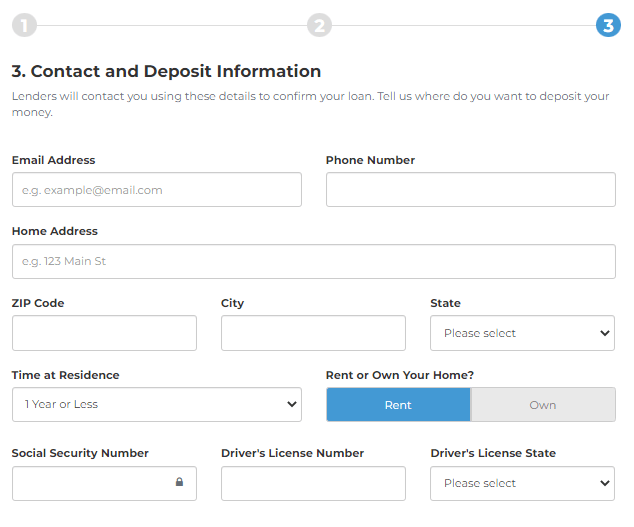

Finally, using Speedy Net Loan, you don’t have to worry about your private personal information or financial data being stolen because the application is secured by the company’s 256-bit SSL encryption.

Application Procedure of Speedy Net Loan Reviews

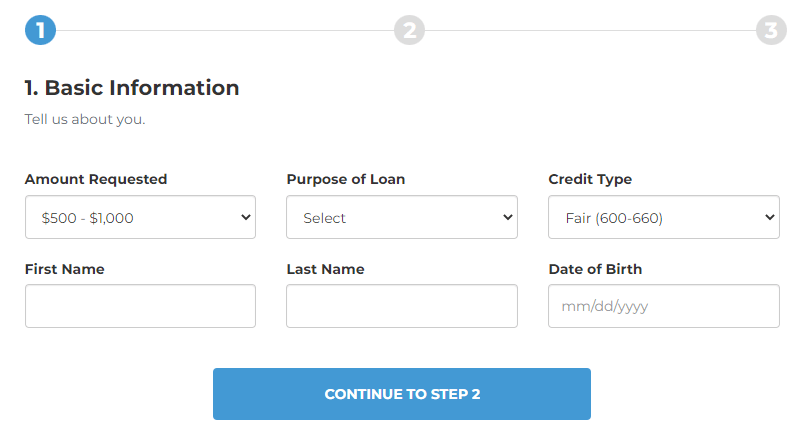

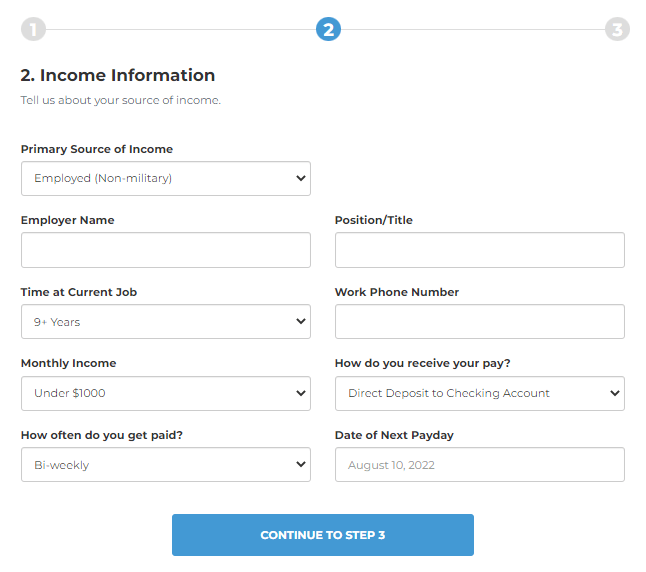

Speedy Net Loan’s application procedure is quick and easy, taking no longer than a few minutes. Visit their website where the application form is located at the top of the page, to get started. There, you will enter some crucial personal data, including your name and email address, as well as the amount you need to borrow. Remember that the maximum amount you can borrow is between $100 and $1,000. You must also enter your zip code to establish your location. This is crucial because only licensed lenders in your state may lend to you, and because each state has its own rules and laws regulating payday loans.

It won’t take more than a minute, at most, once you’ve finished and submitted the application before you hear back. Before connecting you with a lender with whom you will settle the loan, the organization will first let you know if you are eligible for a loan. You might be asked to submit some more paperwork. It may be to confirm: is speedy cash legit? Make sure to include a working phone number because the lender will probably call you to acquire more details before transferring the money to your account.

Refund Terms of Speedy Net Loan Reviews

When your loan’s due date approaches, the majority of the online payday lenders Speedy Net Loan partners will immediately take the amount from your account. Depending on when your payday is, as we have discussed in these speedy loan reviews, your due date will fall on or near that day. Now, the lender’s policies will determine what happens if you don’t make the repayment or are late. Some lenders permit the loan to roll over to the following period, but at least the fee must still be paid.

It is highly advised you complete the payment on time and prevent stacking up the costs because you will have to pay another fee on top of your loan when your next payday arrives. Additionally, keep in mind that many states do not permit loan rolling over.

Duties & Fees

It is for good reason that the speedynetloan.com reviews website does not include any information on the interest rates and costs you might anticipate when taking out a loan; they are not in a position to do so as they are not the ones making the loan to you. Different lenders offer a range of lending options, including various loan terms, fees, and APR rates. It is safe to assume that the charge you will have to pay in addition to your loan will be between 20 and 35 percent on average for the industry, and won’t be less than 10 to 15 percent of the loan amount. This also answers the question: is speedy cash legit?

Comparables

| Loan Co | Amount | Excluded States | Not Eligible | Min Income |

|---|---|---|---|---|

| Speedy Net Loan | $100-$5,000 | NY | Federal Employees | N.A. |

| Lendingforbadcredit.com | $100-$40,000 | N.A. | N.A. | $1,000/m |

| Zippy Loans | $100-$15,000 | NY | N.A. | N.A. |

| Viva Loans | $100-$15,000 | NY, WV, DC | N.A. | N.A. |

| Excel Online Loans | $500-$20,000 | NY, DC, WV | N.A. | N.A. |

| Bad Credit Loans | $100-$10,000 | N.A. | N.A. | N.A. |

You Must Read: Secured vs Unsecured Loan & Payday Loans Vs Personal Loans